Since the Fed announced its rate cut on July 31st, talks of recession have consumed the markets. With the pending Fed meeting on September 17th, it is largely expected that a consecutive rate cut will follow. A continuation of rate cuts would indicate that the Fed believes the US economy is contracting, and thus we are more likely to be closer to the looming recession.

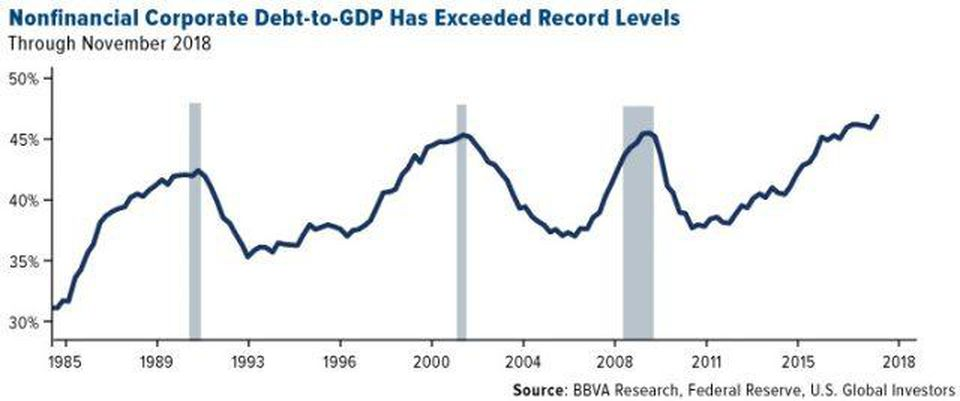

According to Economist John Mauldin, “Lower asset prices aren’t the result of a recession. They cause the recession. That’s because access to credit drives consumer spending and business investment. Take it away and they decline. Recession follows. The last credit crisis came from subprime mortgages. Those are getting problematic again. But I think today’s bigger risk is the sheer amount of corporate debt, especially high-yield bonds.”

Economists such as Mauldin are pointing to the high levels of corporate debt as the cause of the next recession, or in other words, the “bubble”. Bubbles occur when the market prices an asset above it’s true value. For investors seeking yield but wanting to avoid the risk of investing in corporate debt, real estate investments are a suitable option.

Real estate investments, particularly multifamily, are often recession-proof investments. Multifamily real estate is recession-proof because during down markets renters have largely proven to maintain their rents. Such housing doesn’t carry the risk of other classes such as single family. The charts below show the percentage change in the prior year for rental and for sale houses from 2008 to 2018. As illustrated below, during the recession of 2008, rental vacancies dropped less than 1% in the following year while housing vacancies decreased by 10%.

The Fed’s next meeting may indicate how quickly the looming recession could occur, but sophisticated investors will position themselves to be prepared in advance.