Savvy real estate investors are always looking for ways to diversify their portfolios while getting involved in types of real estate assets that are increasing in popularity.

One way to make that happen is to invest in real estate investment trusts, also referred to as REITs. Another way is to partner with an experienced sponsor to invest directly in a specific asset. However, there is a difference between investing in senior housing opportunities through REITs and direct investing in individual facilities as those offered by Lloyd Jones.

This article examines some of the pros and cons of each by comparing the two investment options.

REITs, which are similar in some ways to mutual funds, are designed to let investors earn dividend-based passive income.

When you invest in a REIT, you are essentially purchasing shares in a portfolio of hundreds or thousands of real estate investments. In the same way that you purchase shares in a mutual fund or in an individual company on the New York Stock Exchange, these shares hopefully provide dividends and can even be liquidated if you decide you want to sell some or all of your shares in the trust.

With direct investment, on the other hand, you invest in a particular asset. You own the “bricks and mortar” and participate in the income and appreciation. But you must be prepared to hold the investment for a few years.

One asset class that has recently surged in popularity due to the considerable aging of the U.S. population is senior housing. REITs that purchase and manage properties that pertain to senior housing have become increasingly popular among investors.

Understanding why senior living REITs – and senior housing in general – are good investments and determining where they fit in your portfolio can help ensure that you’re taking advantage of every investment opportunity available to you.

Related: Lloyd Jones Senior Living community featured in Argentum’s ‘Heroes Work Here’ stories

Why Senior Living Is Such a Hot Investment

For investors who like to focus on the long-term viability of their portfolios, senior living has quickly become one of the hottest asset classes in the world of real estate investing. The number of baby boomers in the United States is increasing rapidly.

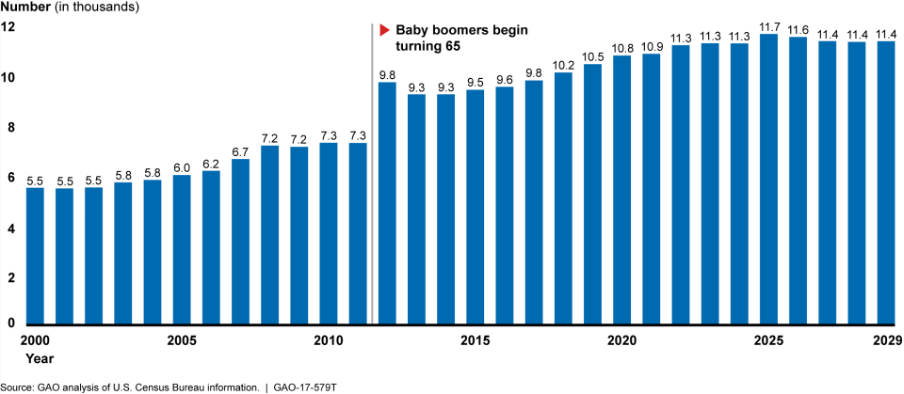

According to studies, 10,000 baby boomers turn 65 years old every single day. As that pace continues, it is forecast that there will be around 80 million senior citizens within the next decade. That rate of growth is double what it was at the beginning of the 2000s – see chart below.

Source: https://admin.thefiscaltimes.com/sites/default/files/media/Boomers%20turn%2065%20chart.png

The projected health of an investment in any class is based on the same principle: will there be an increased demand for this type of asset going forward

If the answer to that question is yes, the investment class can be considered a good one, at least from the demand side of any underwriting equation. As the chart above shows, the number of senior citizens in the United States is going to increase significantly over the course of the next decade, precipitating a strong demand for appropriate housing.

The current life expectancy in the United States is around 77 years old, based on a study published by Health System Tracker – with Covid accounting for the drop in life expectancy in 2020.

Life expectancy has been increasing for decades (with the exception of the COVID dip) and is likely to continue its upward trajectory. With extended lifespans, seniors will be requiring not only appropriate housing, but also services, for a number of years.

Savvy investing is all about understanding how to interpret data to make the best financial decision for you. Based on the numbers surrounding senior living in the United States, we are witnessing an opportunity to invest in an asset class that shows outsized growth in demand and an alarming lack of supply.

Learn more about how Lloyd Jones can help you make lives better with senior living management services.

Multiple Types of Senior Living

To many, “senior-living investment” means investing in a REIT that owns and operates nursing homes. Certainly, nursing homes comprise one component of senior living, but it’s an intense, late-life segment.

Senior living can refer to communities for active adults as young as 55 years old. In addition, there are independent-living communities, assisted-living communities, and facilities for those needing memory care.

The senior-living market (with various age and acuity levels) is ripe with investment opportunities -whether through a REIT or a direct investment with an experienced partner.

Also read: How Social Connections Keep Seniors Happy, Healthy and Living Longer

Flexibility in Senior Care Facilities

Here at Lloyd Jones, we are seeing a continued evolution of the senior housing market and are preparing to capitalize on those changes.

For example, as the population ages and lifespans increase, a wellness-centered, socially active lifestyle becomes a priority. This results in an increasing demand for independent living that offers active, maintenance-free living and also provide access to higher levels of care at the same facility as a person ages.

Independent living communities, retirement communities, and other similar options are increasingly popular for people who are entering their senior years, who no longer have the desire or energy to take care of the large homes that they raised their families in, but who do not yet have need for assistance.

They are, however, conscious of the likelihood of future needs and so seek out communities where they can age in place, while starting their residency entirely independent of any assistance. Simply stated, longer stays by residents who want to age in place means less turnover expense, happier residents, and better returns for investors.

Providing senior housing options that cover the full range of acuity needs is one of the hallmarks of the Lloyd Jones approach to senior housing. Demand for senior housing is growing, and while it often requires higher levels of care as a resident ages, it does not always start that way.

The Risk of Oversupply

As is always the case with any type of investment, there are potential challenges to consider. For instance, as the number of senior citizens is expected to grow significantly over the next ten years, senior housing developers are increasingly looking to fill the demand gap.

Right now, that gap is said to be about 1,000,000 new housing units over the next twenty years.

An increase in supply can put downward pressure on pricing in certain markets leading to lower overall returns for investors. Additionally, individuals selecting REITs as their investment vehicle are going to be subject to volatility in their holdings depending on the daily news cycle about how the senior housing market is faring.

This is a natural result of holding completely liquid assets that behave like stocks.

On the other hand, investing in individual assets is virtually immune to stock market volatility and the perception of the overall market because investors can choose specific locations and investment opportunities that meet their particular investment criteria.

In short, in comparison to investing in senior housing through a REIT, investing directly in individual assets provides investors with a laser-focused opportunity to identify specific locations and sponsors where oversupply considerations are baked into the underwriting assumptions, and the risk of competition has been mitigated.

Pandemic Impacts: Now and Later

It’s no secret that the COVID-19 pandemic ravaged virtually every area of the United States economy, and the economies of nations all around the globe. Just as essentially every industry in the world was impacted by the pandemic, the real estate industry certainly felt the effects.

At the height of the pandemic, many senior-housing facilities around the nation started refusing new admissions. In order to contain the virus, administrators followed recommendations from the CDC and state medical professionals and closed their doors. Obviously, the elderly and those with pre-existing conditions were among the most susceptible to the virus.

With a sudden decrease in the number of people in these assisted-living facilities and nursing homes and a sudden reduction in demand as seniors preferred to stay isolated in their own homes or were refused access to facilities, investors saw a temporary decline in the value of their investments.

However, that trend is reversing and now presents a perfect opportunity to invest as the market remains slightly depressed but is on an uptick. Occupancies have started to turn around, but the pricing of these assets has not yet responded, so now is the time to find undervalued assets to optimize returns as the market begins its bounce back.

Also read: Is Declining Occupancy Affecting the Senior Housing Market?

REITs vs. Direct Investing

If you believe that senior living is a viable investment option for you, it is crucial that you are informed about all of your options.

For instance, while REITs do provide an opportunity to earn passive income through real estate investing, they are certainly not the only option. You can also choose to invest directly through a sponsor such as Lloyd Jones acquires and manages senior living assets and provides you with the opportunity to pick and choose which specific facilities you want to invest in.

Unlike REITs, these focused, direct investment structures give you a more “hands on” approach to your investment and greater control of the risk-return profiles of the assets you want to invest in.

REITs, while they are a tried-and-true investment model also have potential drawbacks when compared to the direct investment model. For instance, there is a lack of transparency associated with them.

Since they are structured very similarly to a mutual fund, your investment is largely at the mercy of the people making decisions on behalf of the REIT. When you invest in a REIT, you won’t know exactly when your money will be put to work or which specific properties will be purchased.

Conversely, when you work directly with a sponsor, you receive more information about when and where your money will be put to work and will know exactly which facilities you are investing in, allowing you to better develop your own financial plan. In regard to planning, it can be difficult for REIT investors to discern how a given property is performing, as it is only a part of the REIT’s larger portfolio.

Diversification and the Liquidity Premium

Smart real estate investors understand that having diverse investments is a good way to optimize returns while minimizing risks. Both direct investment and REIT investment can provide this diversity.

With a REIT, diversification comes from being exposed to multiple assets, typically in a single asset class, across a broad geographical area in one investment. Keep in mind, if your chosen asset class encounters economic problems, it can negatively affect the REIT and your investment.

On the other hand, you can invest directly in individual assets, such as those owned and managed by Lloyd Jones. Here the risks are property-specific, but they are minimized by astute underwriting prior to acquisition and professional on-going management thereafter.

Real estate assets in general, including senior-living facilities, are illiquid assets. An illiquid asset is one that cannot be sold quickly.

A REIT stock, however, can be traded in an instant on an exchange – you can buy a share in a REIT one moment, and sell it instantly the next, if you want to. With a REIT, you are not buying bricks and mortar, you are buying a share of stock.

While a REIT is highly liquid, direct investment is not. Investors who do not need immediate liquidity and who are willing to invest in longer-term investments can benefit from a liquidity premium earned from these investments.

The liquidity premium is the outsized returns that investors gain from investing in an asset with “patient” money, i.e. with a willingness to sit on the investment for a number of years without the ability to liquidate the position. In these cases, investors benefit from both income during the holding period and capital appreciation of their original investment, with tax advantages to offset that income.

Here at Lloyd Jones, we believe that your biggest asset as an investor is a team that can help you achieve your investment goals. If you want to learn more about how senior housing investments can fit into your portfolio’s diversification strategy, contact us.