The opportunity is irresistible. Everything points to an incredible rebound in senior housing starting right now and lasting for the next several decades. It is time to invest in senior housing.

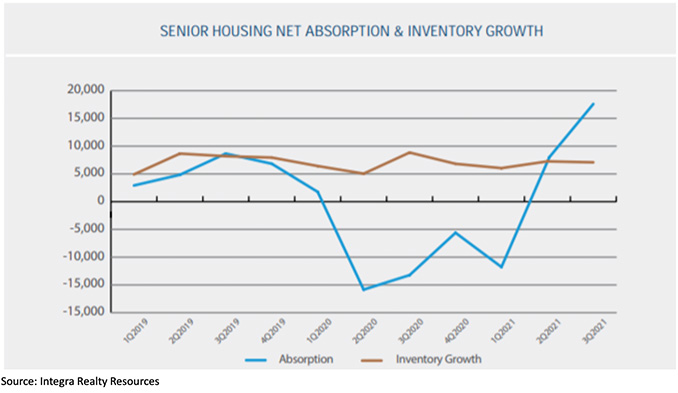

Back in 2018 and 2019, the assisted living/memory care sector was overbuilt. Occupancy was suffering.

Then came Covid. 2020 and 2021 devastated senior housing. Occupancy rates fell. Staffing was difficult – and expensive. Lower interest rates were offset by higher operating expenses and lower occupancy.

Now, it’s 2022. And we’re recovering. And we have four years of built-up demand because there’s been no new supply of senior housing. Demand has caught up with supply. And it takes at least two years to construct a new community. So, the demand will continue. The future of senior housing looks incredible!

Look at this graph!

A report by Integra Realty Resources has forecast that “senior housing demand will increase sharply through 2023, with pent-up demand filling the void.”

And then the baby boomers are coming!!! The oldest baby boomers turned 75 last year. Seniors enter senior housing at about 80 years old, so within the next five years, the tsunami will hit! And Lloyd Jones will be ready.

Join us as we invest in senior housing. It’s something we have been doing for many years, but this is beyond any previous opportunity. Visit lloydjonesllc.com to see our current opportunities.