ESG initiatives, also known as socially responsible investing, incorporate environmental, social, and governance concerns into a company’s business model to deliver both financial and socially beneficial results. While ESG philosophies are applicable to any forward-thinking industry, they can be particularly meaningful within real estate.

Contrary to the popular belief that ESG development is an instance of businesses forgetting their primary purpose–to generate profits–the specific actions guided by ESG-thinking often result in an improved experience for customers and greater returns for investors.

At Lloyd Jones, we’ve implemented specific initiatives related to environmental, social, and governance policies, each with measurable goals, to create a program we call Impactful Investing. Impactful Investing is how our investment, development, and multifamily management divisions each do their part as a socially responsible facet of our vertically integrated real estate firm.

When and Where Did the ESG Movement Begin?

ESG as a movement is not attributed to any one industry, company, or time period. Instead, there is a growing understanding of both companies and investors that socially conscious developments are not just trending; they add value to companies’ brands as well as their returns to investors.

Contrary to the past in which the only consumer concern seemed to be how competitive prices were, and the only investor concern was the levels of returns they were seeing on their investments, both consumers and investors now demand more.

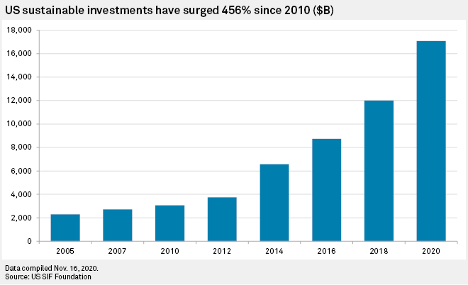

All parties want to know that the businesses they support are improving the quality of life for their employees, the environment, and the surrounding community. As seen in the chart below, ESG investments are growing quickly in the U.S., reaching nearly $17 billion in sustainable investments through ESG in 2020.

Source: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/the-esg-trends-that-will-drive-2021-8211-podcast-61980796

What Is the “E” in ESG?

There are numerous ways in which real estate companies can change their operating procedures to make a positive impact, and one pertains to “environmental,” the “E” in ESG. Almost all of these decisions will fall into three categories: construction, maintenance, and administration, where energy conservation, through implementation of innovative, cost-efficient systems, can be beneficial for the environment and at the same time contribute positively to the bottom line, driving up returns for investors.

Energy Conservation Starts From the Ground Up With Better Materials

Conservation policies can be enacted through simple replacement of common building and property features. Light fixtures, water faucets, and strategically deployed modern technologies save money and provide added value to consumers they may be unable to find elsewhere.

Efficient light and water fixtures like LED lighting and low-flow toilets and showerheads will substantially reduce utility costs for both residents and management. These improvements need not be limited to the interiors of individual apartments, as LED lighting for hallways, parking lots, and walkways can deliver building operators substantial savings across entire developments.

These simple upgrades to common household fixtures can make residential communities more environmentally sound, and by ensuring that the cost of implementing these upgrades can be recovered through cost savings (e.g. utility bill reductions from LED lights) and enhanced rental income, they can also prove profitable.

Residents Expect Smart Tech Amenities

Smart thermostats, electric-car charging stations, and in-apartment hygrometers are all examples of cutting-edge technology that can simultaneously attract higher-credit residents who are willing to pay more rent and stay longer in their units while also providing cost savings to building operators. Keeping ahead of the market with these kinds of technology-driven energy- efficient innovations puts multifamily operators at a competitive advantage to other communities in their area that do not embrace them.

Smart home technologies like Nest thermostats have pierced the public’s consciousness, but these opportunities are just beginning to be implemented in commercial real estate. In addition to thermostats, hygrometers (humidity and water-leak detection devices) can be strategically placed within an apartment to alert tenants and maintenance staff to potential mold or water intrusion issues. These features not only reduce utility costs, but they can also prevent costly repairs down the road.

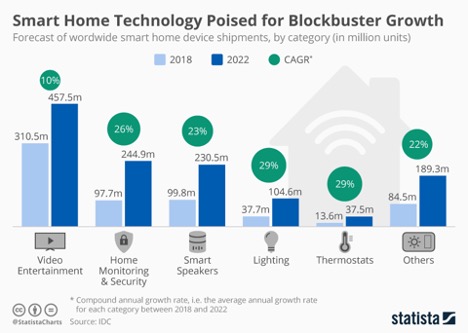

Source: https://www.statista.com/chart/15736/smart-home-market-forecast/

Source: https://www.statista.com/chart/15736/smart-home-market-forecast/

As shown in the chart above, demand for smart tech for the home is growing at a significant pace. As part of its Impactful Investing initiatives, Lloyd Jones recognizes the demand for environmentally friendly technology solutions and is leading the way in the apartment industry by implementing these systems across its multifamily and senior housing portfolios.

Ongoing Utility Audits

After developments are upgraded with energy-saving features, the conservation work continues with utility audits that monitor usage levels to determine when waste is occurring and what repairs are required to return to levels of efficient usage. This serves bottom-line revenues in two important ways: one, with improvements to conservation technology, utility usage levels are reduced with each passing year, and two, it helps to cut building maintenance costs in the long run.

As outdated systems are replaced with smart technology, residents also benefit by seeing a reduction in their own utility expenses, minimized downtime for maintenance of the systems in their units, and an enhanced standard of living and comfort.

Small Administrative Changes Make a Big Difference

Another simple, important, and often overlooked aspect of ESG practices is switching to digital record keeping whenever possible. Beyond contracts, the tasks of paying rent, renewing leases, and effecting transactions that used to require paper are now being conducted digitally to the delight of residents, owners, and the environment.

The frequency and acceptability of digital transactions increased during the COVID pandemic as individuals were unable to or uncomfortable with meeting face-to-face with their on-site property management staff.

Eco-Friendly and Cost-Saving Landscaping Practices for Property Owners

Landscaping is an important part of owning large-scale multifamily residential communities as it forms part of the first impression prospective tenants will get when considering where to live.

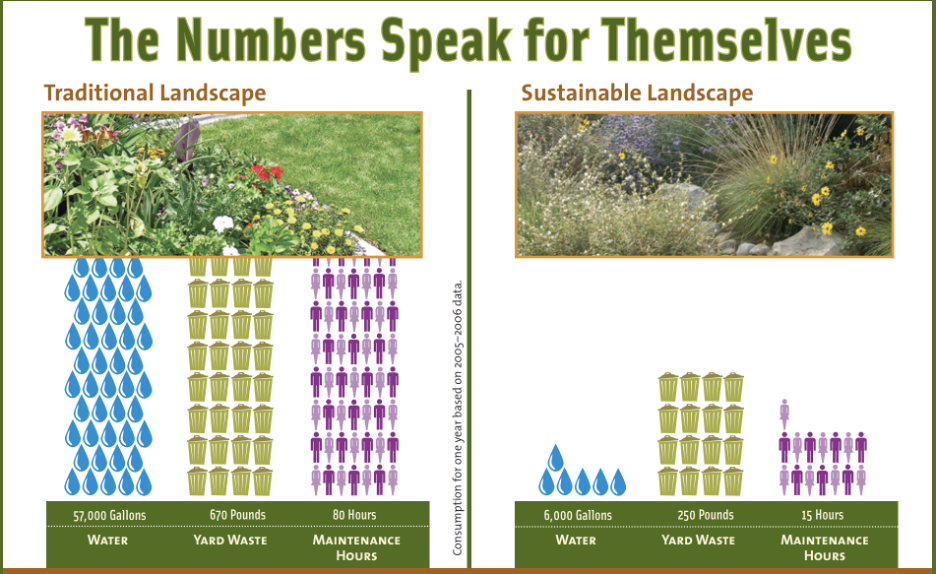

To attract residents, developers often implement exterior landscape designs that look stunning but that do not always account for local climate conditions, for example, planting exotic, water-demanding trees and shrubbery in drought-ridden areas. To maintain the non-native plants, grounds staff must use a wide variety of harmful chemicals and excessive irrigation to encourage plant growth while discouraging undesirable weeds. Switching to environmentally sound landscaping practices that conform to the local climate can be more aesthetically pleasing, allow plants to flourish, cut costs, and increase recreational space for residents.

For example, opting for organic weed killers, switching from gasoline-powered to electric equipment, and encouraging more native-plant landscape architecture are all ways to beautify properties while mitigating environmental damage.

Beyond kindness to the environment, these initiatives are also more cost-efficient in terms of water, waste, and labor, as this study below by the city of Santa Monica, CA, shows.

Source: https://www.smgov.net/uploadedFiles/Departments/OSE/Categories/Landscape/GG.DisplayAd5.e.res%281%29.pdf

Source: https://www.smgov.net/uploadedFiles/Departments/OSE/Categories/Landscape/GG.DisplayAd5.e.res%281%29.pdf

What Is the ‘S’ in ESG?

ESG-focused businesses strive to improve the communities where they are involved and in so doing, bring the “S” for “social” responsibility into practice. While historically limited to volunteer work or fundraising, often called “Corporate Social Responsibility” or CSR, the depth of social development has grown to include partnerships with non-profit organizations and an emphasis on personal and professional growth opportunities for employees.

The possibilities and actions taken by ESG-focused businesses are growing in scope and complexity. Beyond specific partnerships, social responsibility grows at companies through sponsored involvement in traditional volunteerism with food banks, beach and park cleanups, and offering employees personal time off to volunteer with organizations that speak to them personally.

Promoting From Within Builds Stronger Organizations

One of the biggest concerns of modern workers is the chance to grow professionally. Many jobs can lead to dead ends, so initiatives to change this perception of a business is essential. Staffing management positions with internally promoted workers can transform a company from simply a place that provides a paycheck into an organization that provides a meaningful, lifelong career.

Commitment to providing opportunities to workers can take many forms, by offering training programs, certification programs, or even subsidizing continuing education.

Even more simply, and at times most effectively, junior employees are trained by their immediate superiors simply through exposure to the next level of challenges they will face professionally, should they get promoted. Working closely together also allows management to assess employees’ abilities and drive, ensuring that the next opportunity goes to the best possible person for the job.

What Is the “G” in ESG?

Ever growing in importance, potential employees and investors review a company’s internal governance, the “G” in ESG, as a measure for understanding it. Responsible businesses such as Lloyd Jones consider personal conduct and financial accountability essential components in a company’s success.

Both residents and investors want positive outcomes, but they also need to know how the outcomes were achieved, and ESG-conscious companies are aware of that.

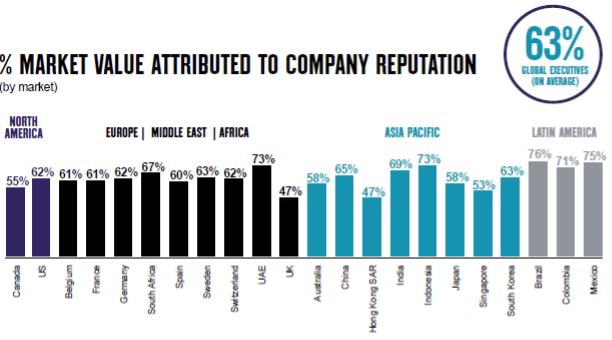

Real estate firms that are serious about growth will need to increase transparency and detail the policies they rely on to enhance the work-lives of their employees, and the home-lives of their residents. As the chart below shows, a tremendous amount of a company’s value is attributed to its public reputation worldwide and by extension, the positive impact employing ESG policies can have on the overall perception a company has in the marketplace.

Source: https://cuttingedgepr.com/good-corporate-reputation-is-vital-especially-during-covid-19-times/

Source: https://cuttingedgepr.com/good-corporate-reputation-is-vital-especially-during-covid-19-times/

Companies that hope to attract the next generation of talent, long term, loyal residents, and the next round of funding from environmentally conscious investors will need to continue implementing and updating their training and internal review programs to stay current with social trends and ethical expectations.

Do ESG-Conscious Real Estate Companies Provide Greater Returns?

While initial investments for building and retrofitting properties involve additional costs, these investments quickly produce higher returns because of the resulting increases in rents, longer tenancies, and cost savings overall. Furthermore, as society expects more environmentally friendly and socially conscious standards, companies that embrace impactful investing will be better positioned to attract this growing body of consumers.

In many ways, ESG-focused developments actually result in lower expenditures than had been required in the past. Environmentally friendly landscaping practices with more natural designs demand less maintenance. Lower electric and water usage results in lower utility bills for residents and operators, allowing for more competitive rents and higher occupancy rates.

While their involvement in the communities of their markets is not the primary reason investors choose to put their money with one company over another, there is a tremendous amount of hidden value for all parties in this.

Connection to local communities and charities delivers returns in unique ways that are not noticed by many.

- The community comes to see the brand as a collection of individuals, not a corporate behemoth. This can have various benefits, including a reduced need for advertising and marketing expenditure as positive word of mouth, either in-person or via online reviews, helps promote the brand and its assets.

- The company can attract employees who would be excited and willing to spend their time (some paid, some volunteering) to help the community in which they live and work.

This willingness to give back is an excellent filtration method to identify employees who are interested in growing with the business and who are committed to a connection with their community.

The amount spent on hiring and training is dramatically reduced as those who fit the business’s persona (a company that gives back) will embrace the corporate culture more readily and be happier in their work knowing they are contributing beyond just their workday to the community also as a result.

- The company saves on recruiting costs through internal promotions and commitment to their employees.

Instead of hiring a third-party talent scout or dedicating an internal employee to perpetually hunt for potential managers, talent can be found within the current employee roster. Further, the knowledge that a company does promote from within encourages entry-level talent that might otherwise take their job search elsewhere.

- Strict and clear internal governance policies serve to ensure investors that employee integrity is maintained to the highest degree, communicating to investors that the company is run by professionals who are willing to spend time, money, and effort to do everything possible to protect the health of the company and the integrity of the brand.

Sustainable Companies Will Trailblaze While Others Simply Follow

Not every company is fully committed to ESG practices, but here at Lloyd Jones, we recognize the growth possibilities of this mindset, the importance to our people on a personal level, and the value it brings to our residents and investors.

While Impactful Investing may remain less prevalent in corporate America than the drive solely for profits, we believe it better to stay ahead of trends, and prefer to lead the way in our industry for the common good.