When investors consider acquiring multifamily apartment buildings, the first step in deciding whether to move forward is to identify what should be done with the building to maximize its potential investor returns. While both extremes, upgrading everything and upgrading nothing, are always possible, neither of these options is likely to produce a desirable outcome.

As with most decisions in real estate, there is a balanced approach that sponsors follow if they want to achieve the highest possible return on investment (ROI). Naturally, an almost limitless number of improvements can be made to any given property, so it can feel overwhelming to figure out which improvements will fetch higher rents… and which will fall flat with renters.

Based on our multi-decade experience in apartment acquisition and management and cumulative thousands of units purchased, upgraded, and sold throughout the course of our history, we have developed a process that simplifies and optimizes returns in multifamily acquisitions. By systematically approaching the evaluation of any acquisition target, we identify the most profitable options and assess whether in the aggregate they will yield the overall returns our investment partners expect.

Most of the work required to determine the proper upgrades to a building is centered on understanding the market and location-specific tenant demands, and in this article we will review some of the most important of those.

Renovating a Multifamily Property for Maximum Return

Many factors go into deciding how to renovate multifamily properties to achieve the highest returns. Starting with a thorough underwriting process, making contact with colleagues in the market, on-site management, and conducting thorough market studies all lead to better returns.

It is best to remember that not every building or neighborhood will need the same types of renovations. Target demographics, predicted growth trends, and the average income of residents in the area are all the factors that guide decision-making regarding which improvements to make and the extent to which a property should be improved.

RELATED: 3 Ways To Add Value In Multifamily Real Estate

How To Decide Which Renovations To Make

Deciding what types of upgrades should be done to a building can only occur after the timeframe of the building’s ownership has been established. Upgrades typically involve extensive capital expenditure (CapEx) which requires a specific amount of time to implement based on projected tenant turnover, as well as time to recoup the initial investment while maximizing investor returns.

Thorough market research prior to purchasing an asset can clearly establish an appropriate length of time to maximize ROI, and there are two primary metrics we use here at Lloyd Jones to determine if a specific upgrade is worth the investment.

The first is the payback period for the additional cost based on increased rents. We like to see capital expenditures on unit upgrades paid back within an 18- to 24-month period. For example, if an upgrade costs $1,200, we would want to see at least a $50 per month bump in rents to justify making that investment – $50 rent increase over a 24-month period would return that original $1,200 cost.

The second metric we look at is the return on investment of the upgrade. Our target is 20%. In the example above, a $50 monthly rent increase yields a $600 annual increase, which is a 50% return on the original investment, so it’s well within our target range.

Another consideration is the extent to which the upgrade contributes to enhancing the overall value of the building. This can be determined by looking at the equity multiple of the CapEx investment itself by measuring the rental increase against the exit cap rate projected for when the building is sold. Using the example above, in a 6- cap market, a $50 per month yielding a $600 increase in annual rents would add $10,000 to the value of the building. Relative to the initial cost of the renovation, $1,200, this would be a multiple of over 8x on the original investment, so it’s well worth implementing.

The Importance of Looking at Market Conditions

During the initial screening of a property and subsequent due diligence, investors should come to thoroughly understand the market and competitive properties. Value is relative to the market where it is calculated, and property owners must know what options are available to consumers within that market. It is important to determine what the competition is doing and what the market can bear. But investors also have to decide where they intend for a property to fall on the value spectrum. Not every property has to be the best property in town, nor does it have to offer the lowest rents. At Lloyd Jones, regardless of the rent prices or the amenity package, we feel it’s important that our communities provide value for our residents.

We provide quality housing that makes lives better. Meet the people that make the difference at Loyd Jones.

The primary goal of studying the market is to determine its parameters and see what types (if any) of upgrades will work for a subject property. The outcome of the research is bound to vary depending on the market, but it is important to recognize that the market dictates strategy and not the other way around.

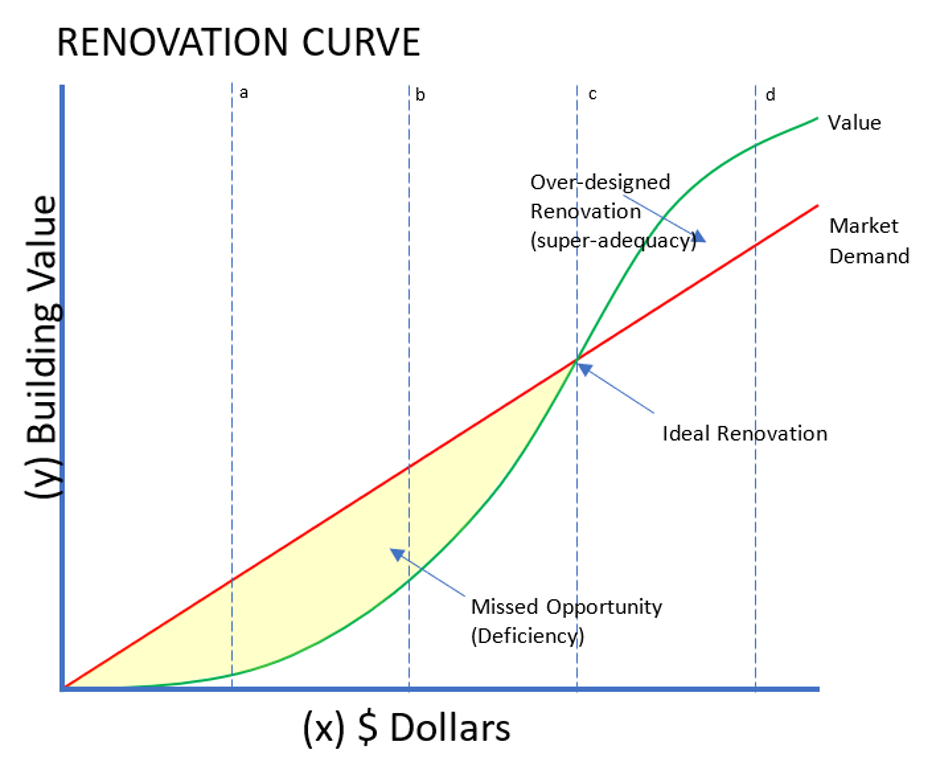

As the chart below depicts, there is a very precise point at which the improvements made match with what the market can bear.

Source: https://www.waremalcomb.com/canvas/multifamily-interior-renovation-qa/

Renovations that return the greatest ROI are always strongly correlated to the subject property’s market. Installing tech packages with smart thermostats and keyless entry only adds value if the competitive product in the area also offers these features or, if they do not, that a market study can demonstrate demand for such upgrades and a willingness and ability of prospective tenants to pay increased rents for them.

How To Increase Cash Flow and Raise ROI

A prolonged, tiered strategy to upgrading multifamily assets allows property owners to retain current residents and maintain a consistent cash flow while gradually upgrading and increasing the rent unit-by-unit as residents move out.

The desire to rush into a new asset, upgrade everything in accordance with the results of market studies and raise the rent accordingly is often unwise in more ways than one. It can be easy to forget that a multifamily apartment is more than an asset classification; it is a building where people live and often have lived for many years. Adding value to an asset requires a balance between maintaining the current resident base to preserve ongoing cash flow and seeking opportunities for turnover acceleration that allow for enhanced asset improvements and value appreciation.

It is productive to make upgrades that current residents can afford, that establish and maintain a good market reputation, and that preserve healthy occupancy rates instead of the opposite, which can result in the building experiencing higher vacancy rates than proforma projections had anticipated. Doing too much, too quickly, in an attempt to boost returns beyond what the local market can handle is a strategy that can backfire and end up requiring property owners to hold assets longer than they intended, making up for months of poor cash flow resulting from high, self-inflicted vacancy rates.

To ameliorate this risk, experienced owners will communicate with on-site management, discuss planned upgrades, see if the required rent increases are compatible with local market conditions, and act accordingly.

How To Maximize ROI on Renovations

Trying to put a specific number of the costs related to upgrades to multifamily units is difficult, but having renovated tens of thousands of units, we have identified some packages that yield the optimal returns on investment. Though this is location specific, of course, upgrade costs, based on an average-size apartment, can be estimated as follows:

- Flooring per unit – $2,400-$2,800

- Appliances per kitchen – $2,500-$8,000

- Countertops (Quartz) per kitchen – $5,500

- Package lockers per building – $30,000-$35,000

As the range of upgrade options and related costs varies tremendously, ensuring that the right package is implemented requires diligence and experience. At Lloyd Jones, our teams ensure that the market is fully evaluated by conducting in-person visits to competing properties, interviewing on-site management of target acquisition properties, and conducting both desk and third-party research.

Some upgrades are easier to determine are necessary and desirable and will produce the ROI we expect. For example, we have determined that in-unit washers/dryers are highly desirable, and are a minimum requirement in many cases; yet, in older buildings, they are often absent. On the higher, luxury end of the scale, we might consider whether the subject community’s targeted demographic has a use for a wine fridge or high end six-burner range and whether potential residents be willing to pay more rent for such features.

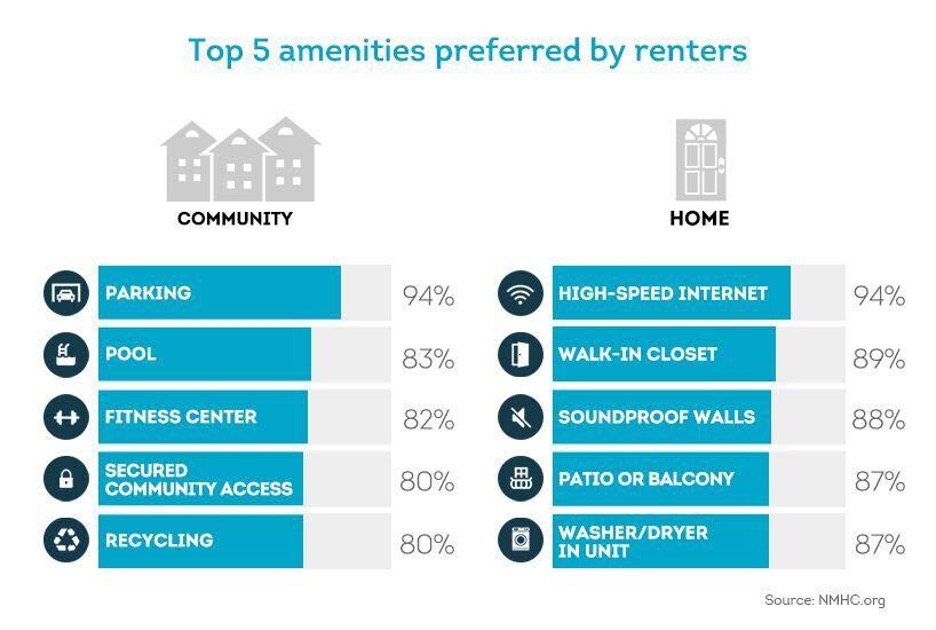

Though deciding what amenities to apply to any individual location requires experience and market knowledge, a 2020 report by the National Multifamily Housing Council, below, indicates what amenities and features are most important to renters, nationally. Keep in mind that these results are national and that specific markets require careful evaluation.

Source: https://www.mysmartmove.com/SmartMove/blog/top-rental-property-amenities-renters-want.page

Which Renovations to a Property’s Exterior Add Value?

Renovations to the exterior of a property are also vital in adding value to an asset, and deciding which to implement must also be aligned with the demands of the asset’s targeted demographic. For example, we have found that in locations with higher demand from young adults, lifestyle improvements such as a tennis court or soccer field might be a big draw for potential residents.

These can cost anywhere from $50,000 to $75,000. For this same demographic – millennial and Generation Z – a modern fitness center might also be the factor that makes them decide between one apartment or another, and this could cost in the neighborhood of $150,000.

RELATED: Gen Z Emerging As Driving Force In Multifamily Rental Market

Although the CapEx for these amenities is considerably higher than for any individual unit upgrades, the ROI is amortized over all the units, so even a small increase in rents, longer tenancies, or frequency of renewals can be accretive to a building’s value-add strategy.

In the case of older residents, who may be less interested in physical fitness but very interested in staying connected with their extended families, a well-designed picnic and event area with a playground, hammocks, and barbeque pits is perfect for large groups to gather in ease and comfort.

In these instances, market studies and communication with local colleagues will make the difference between upgrading far too many features that residents have no interest in and giving them exactly what they want

Landscaping

You don’t get a second chance at a first impression, and nowhere is this saying more applicable than a property’s landscaping. The curb appeal that initially draws prospective residents to an asset will not be due to anything that lies inside units; rather, it will be the maintenance of the property’s grounds.

Furthermore, by enhancing the exterior “curb appeal” of an asset, owners can set residents’ expectations of where pricing is likely to be relative to other properties in the market. Assuming all things are equal, a community with well-designed and attractive exterior landscaping will command higher rents than one that is outdated, run-down, and in need of maintenance.

Choosing plants that are native to the area and climate in which they will be installed is not only cost-effective and environmentally friendly, but it also frames the property as one that fits within the community in which it is located. Making this choice simultaneously adds value and cuts the costs related with selecting a variety of plants that are not ideally suited to the environment in which they will reside.

Dog Parks

Dog parks are an increasingly popular amenity that provide great value with relatively low initial investment. Beyond simply being something that residents want, many residents will only choose communities that provide pet amenities.

In contrast to traditionally accepted truths, dog and pet owners are generally among the most reliable and respectful residents that owners could hope for. We have found that these residents are among the more diligent and conscientious of our tenant base, as well as those who tend to stay longer as they like to maintain stable, long-term residences for their pets as much as they do for themselves. Furthermore, taking pet deposits can mitigate the cost of repairing any pet-related damage when a tenant vacates, and charging additional pet rent adds to overall rental income.

Pet washes might be seen as superfluous, but they are a great way for a property to differentiate itself from market comps. This addition usually costs around $15,000 but can be the difference-maker when it comes to attracting tenants with pets who, as noted, stay longer and pay more rent.

Parking Lots

Contrary to how many property owners have viewed parking in the past, parking can be a great way to generate ancillary income. Particularly in hot climates, residents are willing to pay more for parking that delivers a better user experience than traditional first-come-first-served parking.

The costs of providing parking are simply the cost of doing business and will run $20,000 to restripe (repaint) a 350-spot lot every 2-3 years. Further, these lots will require resurfacing every 5-10 years at the cost of $35,000-$50,000. The resurfacing cost varies depending on the local economy, and the timeframe often depends on the parking lot’s climate and proximity to saltwater. Just as windows with high exposure to ocean mist will require replacing sooner than those that do not, so do parking lots.

An additional consideration we look at is covered parking with the option for solar panels on the overhead structures. Not only is it possible to charge more (sometimes as high as $75) than for regular assigned parking ($25-$35), there is also an opportunity to reduce the asset’s energy costs through solar power generation that will deliver increasing returns over the years.

Lastly, although decreasing in popularity, are garages. It might be necessary to provide residents with parking garages in storm-prone areas, although these structures are costly to build and often decrease the community’s visual appeal. The perk of garages is that it is possible to charge higher rates ($125-$175) than for assigned or even covered parking.

Costs of Improvements Relate to Larger Economic Cycles

During periods of high unemployment, the costs of improvements usually decrease as contractors and sub-contractors all compete for work by reducing their prices. Other macro-economic influencers can cause actual costs to vary unexpectedly from those projected during initial underwriting. For example, during the first few months of the COVID economy, prices dropped precipitously as both demand and supply plummeted as owners pulled back and contractors figured out ways to deliver their services safely. Then, during the post-COVID economy, costs shot up when pent-up demand was released and vaccinations brought life back to normal allowing construction to return to pre-COVID levels.

RELATED: Strategies For Collecting Rent Payments During A Crisis

Increased demand for labor is resulting in businesses poaching workers from each other. As a result, property owners and managers need to spend more on labor costs to simply maintain their current level of maintenance productivity. At the same time, material costs have increased due to higher demand and lower supply levels due to labor shortages and shipping complications.

These realities require upgrades to newly acquired assets be planned carefully, with solid communication between owners, contractors, and suppliers. It is also wise to consider that despite promises of on-time delivery of materials and labor, extenuating circumstances might make keeping a schedule difficult. Fortunately, having been through multiple economic cycles and black swan events, Lloyd Jones is well equipped to “expect the unexpected” and to mitigate risk of downturns by underwriting projects with the assumption that there will be disruption of some sort.

When To Repair and When To Replace During Renovations

Partnering with a trusted contractor is essential when deciding what to repair and what to replace. In addition to construction professionals that advise on decisions, a thorough building inspection report, both in-house and, where necessary, by third-party contractors conducted prior to purchase gives invaluable information.

Information like the construction year, materials, and current condition can all give clues to whether something has to be replaced or is otherwise near the end of its useful life. It is also important to acknowledge if the style or design of an apartment unit feature feels particularly dated and might benefit from upgrades to boost rents.

The quickest example of this is the toilet. Toilets are generally long-lasting fixtures that do not often need replacing. At the same time, nothing indicates the age of a building quite as quickly as an old toilet design. This is an instance in which a completely functional plumbing fixture should probably be replaced because its style is likely to decrease the value of the unit, and building, overall.

With this example, consider what other elements of an apartment can give it a particularly dated feel that no repairs or improvements will be able to hide. While colonial molding and baseboards seem to be timeless, doing nothing to the perception or value of the units, other styles can immediately give prospective residents the impression that, despite a smart thermostat and new fitness center, this is an old building, and the recent improvements are simply window dressing.

As with any renovation, evaluating a potential acquisition takes time and patience. At Lloyd Jones, we will inspect every single unit individually, creating checklists to ensure that we fully understand the asset before making a commitment to buy. Having a broad level of collective knowledge and experience here at Lloyd Jones allows us to decide what should get fixed up and what should get shipped out.

Conclusion

The most important way to determine what the costs of renovating a potential acquisition is to conduct thorough analysis of the current state of the asset and to understand the demographics and competition in the surrounding market.

And the best time to do this is before acquisition so a comprehensive upgrade package can be designed, priced, and scheduled for post-acquisition implementation. This has been standard practice for Lloyd Jones for decades as it is the best way to optimize ROI for our investment partners.

Let us help you build your community one step at a time. Contact Lloyd Jones today to schedule a consultation.