Celebrating 45 years under the continuing leadership of Christopher Finlay, Lloyd Jones has become a global real estate investment firm with subsidiaries in development, construction, and senior living operations.

Its investment partners include institutions, family offices, and its own principals.

“The vertical integration of our divisions ensures that we are fully aligned with the goals of our investment partners throughout the entire investment period.”

Working with Lloyd Jones has been a great experience they provide great expertise in the multifamily space. From underwriting our acquisition, financing and day to day operations it has been top notch. Chris and his team are just superb partners.

LJ is the best partner that an LP can hope to have. Their level of governance and thoroughness in information disclosure is the most impressive. The asset management team responded quickly to the change of market and have a good control of the operating cost, which makes the actual NOI outperform the budget. They excel at creating value for the LPs.

Trust and loyalty are integral to happy and fulfilling relationships in both our personal and professional lives. Our partnership with LJ is based on this foundation and shares values and goal with a long-term commitment.

View some of the latest publications talking about Lloyd Jones

To support our ambitious growth and performance goals, we have recruited exceptional investment and operating talent from America’s top institutional firms. Our team is remarkable in its expertise and experience and positions us with institutional-level capabilities.

Lloyd Jones has reactivated A.B. Lloyd Construction, its construction arm that participated in the firm’s growth during its development days. Its history includes twenty post office facilities for the U.S. Postal Service, luxury condominiums, and multifamily communities.

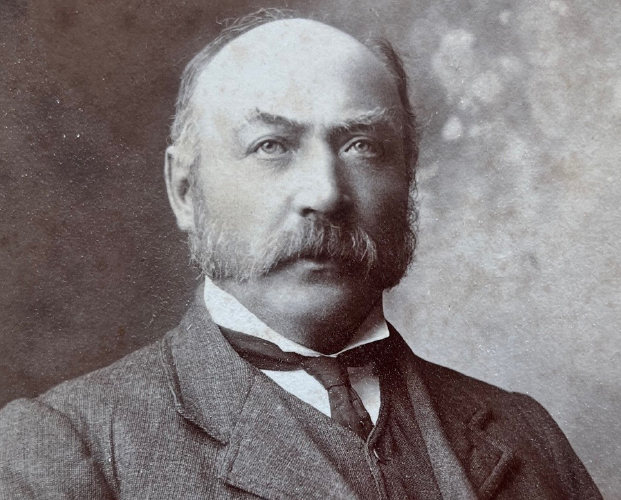

But the history goes back even further – to AB. Lloyd Construction in Flint, North Wales in the early 20th century. Alfred Bibby Lloyd was our founder’s great- grandfather who earned a reputation for his integrity and work ethic in building commercial buildings, churches, and hospitals. And his photograph still hangs in City Hall where he served as mayor for several terms. So perhaps we can say that we’ve been in business for generations.

A a subsidiary of Lloyd Jones, A.B. Lloyd Construction is responsible for identifying and implementing our capital improvement strategies by which we add value to our investments. The scope includes structure, building systems, technology, even cosmetic improvements.

In addition, this group oversees all ground-up construction and adaptive reuse projects.

Vertically integrated with the entire Lloyd Jones team, A.B. Lloyd works closely with the other entities to ensure business plans are fulfilled pursuant to the goals of the investors.

Having been in the real estate industry now for almost 45 years, there isn’t much I haven’t seen or experienced,” said Chris Finlay, CEO & Chairman at Lloyd Jones. “I’ve learned that every change in the economic environment brings opportunities.

Christopher Finlay

Lloyd Jones has successfully invested in and operated multifamily and senior housing real estate for four decades: as managers for the FDIC in the ‘80s, and as developers, investors, and managers of multifamily and senior housing assets thereafter. Since 1990, Lloyd Jones has developed, owned, and managed approximately $1.2 billion in multifamily real estate.

We are proud to be defined by our results: award-winning developments and investment returns averaging 29.03% IRR and 2.71x equity multiple over the past ten years.

The name Lloyd Jones was chosen to honor our founder’s Welsh great-grandfather, Alfred Lloyd, and grandfather, Hugh Jones. Lloyd was a master builder and became known for his work for the Duke of Westminster as well as the construction of churches and schools. He was also elected mayor of Flint, North Wales for several terms. Jones was the owner of the local foundry. Both were highly respected businessmen and community leaders, and the family reputation for sound business practices and strong work ethic created an undeniable legacy for Chris Finlay from the time he was a boy.

The Welsh dragon symbolizes this proud heritage that continues to inspire Chris and his team in the work that they do for their partners, investors, and residents.

1980

Christopher Finlay creates the Finlay companies which grow to be among the largest real estate firms in New England:

1990

The FDIC and RTC contract Finlay to handle the management and disposition of their ORE assets acquired as the result of the savings & loan crisis and recession.

The United States Postal Service chooses Finlay to develop and manage post office facilities across the country.

1993-2008

Finlay begins developing multifamily and senior housing communities, ultimately ranking among the top five producers of Housing Tax Credit properties. Development continued for fifteen years until the Great Recession.

1993-2008

Finlay continues development activities through 2008: workforce housing, senior living communities and luxury condominiums.

2010

Finlay and family member begin accumulating a portfolio of apartment communities for their own account.

2013

Building on his investment success, Finlay creates Lloyd Jones Capital, a private-equity real estate investment firm offering outside investors an opportunity to participate in his acquisitions.

2016

The massive baby boomer generation begins turning 70, creating senior housing opportunities.

2018

Finlay merges Lloyd Jones Capital with the Finlay companies to create Lloyd Jones, a vertically integrated owner/operator of multifamily and senior housing.

2019

Lloyd Jones recruits a veteran of the senior housing industry to run newly created Lloyd Jones Senior Living Management as the firm aggressively enters the senior housing market.

2020

Under the continuing direction of Christopher Finlay, Lloyd Jones celebrates its 40th anniversary as a private-equity real estate firm focused on multifamily and senior housing investment and operations.

2021

Recognizing a changing economic environment, the firm disposes of its multifamily portfolio at peak of market realizing substantial returns for its investors.

2022

To capitalize on emerging opportunities, Lloyd Jones Senior Living changes its name to AVIVA Senior Living.

2022

Lloyd Jones expands senior housing holdings with 11 acquisitions, ending 2022 poised to scale the portfolio nationally.

2025

Lloyd Jones celebrated its 45-year anniversary as it turns its focus exclusively to senior living investment and operations.

You are now subscribed to receive email communications from Lloyd Jones.

When it comes to multifamily real estate investment opportunities, Lloyd Jones understands that it is important to have our hands on the wheel at all times. We focus on the markets and products that we know better than anyone, and we ensure every investment made is direct from us. Looking at both multifamily and senior housing opportunities, we focus on the Southeast, most often Florida and Texas.

We always want to provide our partners with a steady cash flow along with considerable capital appreciation. Since 1990, our total investment/development has reached $1.2 billion and our partners are happy with the tax benefits they receive, the stability of the market, and their property value increasing with inflation. Now, we are excited to offer our institutional-quality real estate investment opportunities at check sizes as low as $500k. We are looking to invest in a common goal. Raising this capital would mean we could acquire more multifamily and senior housing properties.This is going to be offered internationally as well as in the U.S! We have a capital markets team member who is focused exclusively on making connections in Latin America, with a focus on Argentina, Chile, Brazil, and Mexico. As we know, multifamily real estate is part of commercial real estate and qualifies as an alternative investment. What we see in this market unlike any other is consistency. We do not see the fluctuations that the stock market does. With our dedication, in-house investment/analyst teams, resources, and experiences of our multifamily and senior housing management divisions, we could not be more excited for the future.

In our four decades of working and investing in the multifamily real estate environment, we have gained so many useful insights and resources. What we love most though is partnering with people who are just as eager as us to get to the next step in the process. We are ready to take the first step, are you?

During periods of economic uncertainty, diversification is one of the best ways to protect the value of an investment portfolio. Real estate low correlation to the stock market provides diversification, smoothing potential losses and volatility. Historically, private equity real estate has outperformed stock and bond market risk-adjusted returns over the past 40 years. Investments in real estate offer steady income and capital appreciation, and multifamily and senior housing assets have proven resilient during downturns. Here are the demographic trends that translate into demand for multifamily and senior housing real estate opportunities:

By 2025, the largest age group in the United States will rise to 34, up from 28 in 2019. The aging of the millennial population will boost suburban demand, as more young couples move out of urban areas looking for more space and better schools for their kids. Suburban apartment rate increases have outpaced urban locations in the last years, and suburbs have an affordability advantage.

Homeownership has been at historic lows, creating an unprecedented demand for rental housing- especially for senior and middle-income working families. Real estate prices have increased more sharply than wages making the acquisition of a house more difficult year over year. Also, affordability is especially a problem for millennials, whose debt burden is too high because of student loans, and therefore debt ratios are difficult to achieve. The affordability gap between renting and owning remains substantial.

All ages are fleeing high-cost cities and states. Six of the 10 states that attract millennials are in the South, and seniors continues to flock to the Sun Belt, the region in the U.S. that stretches across the southern and southwestern portions of the country from Florida to California. 70% of the fastest-growing cities in the U.S. in the last four years are in the Sun Belt. Growth demographics are driven mainly by tax advantages, affordability and quality of life. Moreover, the access to technology and remote work has decreased the benefits of living in the city.

Baby boomers (born between 1946 and 1964) represent one of the largest generations in history (69 million) and 10,000 baby boomers turn 65 every day. This trend will continue, and by 2050, the 65+ age group is estimated to exceed 88 million, double today’s count. The need and demand for senior housing will only increase as baby boomers require health and wellness services. The future demand for senior housing is twice the annual production of the past five years.

Sources: Marcus & Millichap Research Services, PGIM Real Estate, Cushman & Wakefield